非织造制造业是一个动态的行业,在各个领域起着至关重要的作用,从医疗保健到汽车和建筑。随着我们进入2024年,该行业以可持续性、技术进步和市场动态变化为标志。公司日益采用环保实践,利用尖端技术,扩大其全球业务范围,以满足对高性能非织造材料不断增长的需求。本文深入探讨了2023年十大非织造制造商,探讨他们如何应对这些趋势并巩固其在市场中的地位。

可持续性、技术和市场动态

可持续发展趋势:

非织造制造业越来越注重可持续性,以满足监管要求和对环保产品的需求。许多公司正在投资于可再生原材料,并减少其碳足迹。例如,Freudenberg集团已设定了到2045年实现气候中性的目标,突显了其对长期环境保护的承诺。同样,Suominen公司在将可再生纤维纳入其产品方面取得了显著进展,到2022年,其62%的生产使用可再生自然资源。这些努力反映了整个行业朝着采纳循环经济原则的更广泛趋势,这些原则强调回收利用和使用可生物降解材料。

技术进步:

技术创新在推动非织造行业向前发展起着关键作用。生产技术的进步,如纺粘、熔喷和风力散粘工艺,正在提升产品性能并拓展应用领域。例如,贝利全球公司已投资于Reicofil 5纺粘熔融生产线,为卫生保健应用提供了改善的柔软性、可持续性和屏障性能。此外,智能技术的整合,如”物联网”和人工智能,在制造过程中优化了效率,降低了废物产生。企业还在开发具有增强功能性的高级非织造材料,如抗菌性能和提高过滤效率,以满足医疗保健和个人防护领域新兴市场的需求。

市场动态:

非织造布市场正经历着强劲增长,受到医疗保健、卫生、汽车和建筑行业需求增加的推动。 COVID-19大流行显著提高了医疗和卫生产品的需求,如口罩和消毒湿巾,突显了非织造布在公共卫生中的关键作用。此外,汽车行业向电动汽车转变为非织造材料在电池隔膜和隔热方面创造了新机遇。地理扩张也值得注意,亚太地区由于快速工业化和城市化而成为一个关键市场。各公司正在扩大其地区制造基地以利用增长的需求。

总的来说,非织造制造业正在应对一个充满可持续性倡议、技术进步和不断演变的市场需求的动态格局。这些趋势正在重塑行业,推动创新,并为增长开辟新的途径。

01. 金伯利-克拉克公司

- 营收:204亿美元

- 总部: 德克萨斯州欧文市

金伯利-克拉克公司总部位于德克萨斯州欧文,是全球个人护理产品领军企业。成立于1872年,该公司2023年报告的营收为204亿美元,全球约有42,000名员工。金伯利-克拉克以品牌如Huggies、Kleenex、Scott和Kotex而闻名,其非织造布料对其卫生产品至关重要,因其柔软、吸水性和耐用性而享誉盛名。

公司致力于可持续发展,专注于负责任的原材料采购,减少温室气体排放,并推动循环经济实践。金伯利-克拉克公司的目标是到2030年实现100%可再生电力,并将其环境足迹减半。在2023年,公司大力投资于新技术和流程,以提升可持续性。

凭借对创新和可持续发展的坚定承诺,金伯利-克拉克继续通过其可靠产品和负责任的做法全球改善生活质量。

02. 弗洛伊德贝格集团

- 营收:130.1亿美元

- 总部:德国威海姆。

弗洛伊登贝格集团,总部位于德国维恩海姆,是一家专注于汽车、医疗保健和消费品等各个行业的创新解决方案的全球技术公司。公司成立于1849年,据2023年报告,公司收入达119亿欧元,在全球约有52,241名员工。非织造布部门是其收入的重要贡献者之一,生产用于汽车内饰、建筑、服装和医疗用品的材料。

Freudenberg致力于可持续发展,旨在于2045年实现气候中性。2023年,公司投资6.04亿欧元用于研发,以创造可持续且高性能的材料。其倡导的各项倡议包括开发智能医疗产品,增强电池系统,推进燃料电池技术。Freudenberg对创新和可持续发展的承诺确保其在无纺布行业保持领先地位,同时不断改善其环境足迹并为客户提供先进解决方案。

03. Berry 全球公司

- 营收:127亿美元

- 总部:印第安纳州埃文斯维尔

Berry Global Inc.总部位于印第安纳州埃文斯维尔,是一家领先的全球塑料包装制造商和营销商。截至2023财政年度,该公司报告的营收为127亿美元。Berry Global在其全球众多制造设施中雇佣了大约47,000人。该公司以其多样化的产品组合而闻名,包括容器、薄膜、胶带和非织造材料,服务于医疗保健、个人护理和消费品包装等行业。

Berry Global致力于可持续发展,通过实施各项倡议,力争在2050年实现净零排放。他们的努力包括开发循环塑料、参与价值链合作伙伴关系,并投资于可再生能源。通过其创新和可持续的包装解决方案,Berry Global继续推动在竞争激烈的无纺布行业取得成功。

04. 杜邦

- 营收:120亿美元

- 总部:特拉华州威明顿。

杜邦公司,正式名称为E.I. du Pont de Nemours and Company,是一家著名的美国跨国企业,由伊雷尼·杜邦于1802年创立。最初专注于火药生产,杜邦已发展成为一家领先的科技公司。总部位于特拉华州威明顿,杜邦在电子、生物技术和先进材料等领域开展业务。

杜邦的非织造布部门是其收入的重要贡献者,拥有诸如Tyvek、Sontara和Kevlar等各种产品。这些材料在医疗、建筑、汽车和个人防护等行业中至关重要。例如,Tyvek因其耐用性、轻便性以及对水和化学品的抗性而被广泛用于防护服、医疗包装和建筑外壳。

杜邦致力于可持续发展和创新,大力投资于研究和开发,生产环保和高性能材料。该公司旨在到2050年实现零排放,专注于循环经济原则和可再生能源。

拥有两个多世纪的历史,杜邦公司继续引领创新,提供先进解决方案,应对全球挑战,改善日常生活。

05. Ahlstrom-Munksjö

- 收入:32.5亿美元

- 总部:芬兰赫尔辛基。

Ahlstrom-Munksjö总部位于芬兰赫尔辛基,是可持续和创新的基于纤维的解决方案的全球领导者。该公司于2017年通过合并Ahlstrom Corporation和Munksjö Oyj而成立,借鉴了超过160年的经验。2023年,Ahlstrom-Munksjö报告的营收为29.7亿欧元,并在全球拥有约6,931名员工。

Ahlstrom-Munksjö专注于生产高性能纤维材料,用于各种行业,包括过滤、医疗保健、食品包装和建筑材料。他们的产品组合包括装饰纸、脱模纸、无纺布和特种纸,以其质量和可持续性而闻名。该公司强调使用可再生纤维,占其总纤维使用量的95%。

公司深信可持续发展,旨在于2045年实现气候中和。其倡议包括减少环境足迹,提升产品可回收性,以及开发环保解决方案。2023年,Ahlstrom-Munksjö大力投资新技术和流程以支持这些目标,确保他们仍处于无纺行业的前沿。

06. 约翰斯·曼维尔公司

- 收入:超过30亿美元

- 总部:科罗拉多州丹佛市

约翰斯曼维尔公司是美国领先的绝缘材料、屋顶材料和工程产品制造商。总部位于科罗拉多州丹佛市,约翰斯曼维尔有着可以追溯到1858年的丰富历史。多年来,该公司发展壮大,已成为非编织材料行业的重要参与者。目前,约翰斯曼维尔是巨大的伯克希尔哈撒韦公司的全资子公司,该公司在2023年实现了5010亿美元的营业收入。

约翰斯曼维尔的非织造产品在各种应用中起着重要作用,包括建筑隔热、商业屋面和机械隔热。该公司的多样化产品组合还涵盖过滤介质、土工布和先进纤维。2022年,约翰斯曼维尔报告的营业额超过30亿美元,突显其强劲的市场地位。

约翰斯·曼维尔公司在北美和欧洲拥有44个制造工厂,为全球客户提供服务。该公司以创新和质量闻名,不断提升其产品供应以满足行业需求。约翰斯·曼维尔公司还致力于可持续发展,专注于通过节能制造工艺和可持续产品开发来减少其环境影响。

约有8,000名员工,约翰斯曼维尔的使命是提供能够提高能源效率、舒适性和安全性的解决方案。公司对创新、质量和可持续性的执着继续推动其在竞争激烈的非织造行业中取得成功。

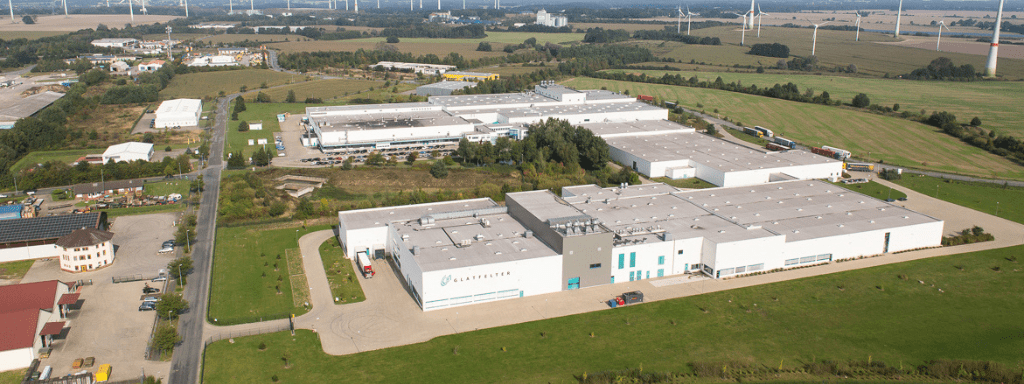

07. 嘉特菲尔特公司

- 营收:14亿美元

- 总部:北卡罗来纳州夏洛特

Glatfelter公司总部设在北卡罗来纳州的夏洛特市。它是生产工程材料的全球领军企业。该公司成立于1864年,多年来发生了重大变化,从传统的纸制品制造商转变为非织造布行业的主要参与者。Glatfelter专注于空气针刺、湿法和纺粘非织造材料,这些材料在个人卫生、医疗保健和工业领域等各种应用中起着关键作用。

2023年,格莱特菲尔特(Glatfelter)报告了约14亿美元的营收,反映了其强劲的市场地位和不断扩大的能力。该公司的非织造产品对婴儿湿巾、成人失禁产品、茶包和家居装修材料等物品至关重要。格莱特菲尔特在北美、欧洲和亚洲拥有12家制造工厂,为全球客户提供服务,确保高质量和可靠的供应链。

Glatfelter 致力于可持续性和创新。它专注于通过可持续性原材料采购、能源高效制造工艺以及生态友好产品的开发来减少其环境足迹。该公司的战略举措包括持续投资研发,以满足客户不断变化的需求,并推动未来增长。

08. Fitesa

- 收入:14亿美元(2022年)

- 总部:巴西波多阿莱格雷

Fitesa总部位于巴西波多阿莱格雷,是非织造织物行业的全球领导者,主要为卫生和医疗保健市场提供服务。成立于1973年,Fitesa已经发展成为一家大型无纺纺丝融融纺织品生产商,在美洲、欧洲和亚洲拥有强大的存在。该公司在13个国家设有23家生产工厂,强调其广泛的全球覆盖范围。

2022年,Fitesa自愿报告了14亿美元的收入,其多样化产品组合包括纺融、羊毛、湿法、薄膜和弹性材料。这些非织造材料被用于各种应用,如女性卫生用品、婴儿护理、成人失禁、医疗用品以及农业和工业产品。Fitesa以其创新的方式而闻名,拥有五个创新中心和三条试验线致力于推动非织造技术的发展。

可持续发展是Fitesa的核心价值观,该公司在可持续实践和环境友好产品开发上投入了大量资金。该公司致力于可持续性体现在其可再生能源和努力减少环境影响上。Fitesa不断投资于创新和可持续性,确保其在无纺布行业的领导地位。

09. 索伊明集团

- 收入:493百万美元

- 总部:芬兰赫尔辛基。

芬兰赫尔辛基的Suominen Corporation是非织造布行业中的知名企业,特别擅长生产用于擦拭、卫生和医疗应用的非织造布。2023年,Suominen报告的净销售额达4.509亿欧元,全球雇员人数约为673人。

Suominen在美国、巴西、西班牙、意大利和芬兰设有生产设施,为全球市场提供服务。该公司致力于可持续发展,拥有多样化的产品组合,采用可再生、回收或无塑料原材料制成。2023年,Suominen 79%的销售额来自可持续产品,反映了该公司对环境责任的强烈承诺。

最近的举措包括新纤维中心项目,该项目探索了大麻、亚麻和稻草等有机纤维的潜力。苏米宁继续创新和扩大其可持续产品供应,确保在无纺布市场的领先地位。

10. TWE集团

- 营收:4.5 亿美元

- 总部:德国恩斯德滕

TWE集团总部位于德国埃姆斯德滕,是非织造面料行业中的重要私营企业。成立于1912年,TWE集团已发展成为领先的非织造材料制造商,在卫生、汽车、建筑、过滤和医疗等多个市场提供服务。该公司的产品在卫生产品、汽车内饰和建筑材料等领域发挥着重要作用。

2022年,TWE集团自愿报告了4.5亿美元的收入,强调其在市场上的强劲存在。该公司在欧洲和亚洲设有多个制造设施,确保了可靠的供应链和全球覆盖。TWE集团尤其以其创新和可持续的产品系列闻名,例如RePEat产品系列,包括由回收纤维或客户废料制成的材料。这种对可持续发展的承诺进一步体现在TWE集团致力于通过负责任的采购和生产实践减少其环境影响。

TWE集团对先进技术和可持续解决方案的持续投资,确保了其在无纺布市场的竞争优势。 公司对质量和创新的追求将其定位为在各种应用中提供高性能无纺材料的领导者。

结论

总之,非织造制造业正在经历一个由可持续性、技术创新和动态市场需求推动的转型时期。贝利环球、弗洛伦贝格集团、杜邦和金伯利-克拉克等领先公司正在处于前沿,开创性地推动产品性能的提升并促进环境保护。该行业致力于降低其环境影响,并采用智能制造技术,为可持续增长铺平道路。随着市场的不断扩大,特别是在亚太地区,这些公司将处于一个有利位置,以利用新的机会并在全球非织造布行业中保持领先地位。

Thank you for reading our top 10 nonwovens manufacturers list!